786 VCPA

Resources

Welcome to the 786 Chartered Professional Accountant

As a bookkeeping and accounting services provider in Canada, we regularly publish articles to inform, educate, and share our insights and expertise. Do Read our blogs for your knowledge and Business enhancement.

Dangers of Dividends, Shareholder Loans, and Unidentified Withdrawals: Key Considerations for Corporate Compliance

When it comes to corporate funds, any distributions, loans, or withdrawals by shareholders must be carefully documented and handled according to CRA guidelines. Failure to

Pitfalls and Common Mistakes on Corporate Tax Returns

Filing an accurate T2 Corporate Tax Return is critical to avoiding penalties, audits, and reassessments. Pitfalls and Common Mistakes on Corporate Tax Returns 1. Incorrect

The Importance of Financial Planning for Long-Term Business Success

Financial planning is a crucial aspect of long-term business success. It involves setting financial goals, creating a budget, and outlining the steps needed to achieve

How to Streamline Accounting Processes and Save Time

Streamlining your accounting processes is essential for enhancing efficiency, reducing errors, and saving valuable time. By implementing effective strategies, businesses can optimize their financial operations

Understanding the Difference Between Cash and Accrual Accounting

When it comes to managing the finances of a business, understanding the difference between cash and accrual accounting is crucial. Both methods have their own

Understanding the Basics of Financial Statements for Non-Accountants

Understanding financial statements is essential for anyone involved in business, even if you’re not an accountant. These statements provide valuable insights into a company’s financial

The Role of Technology in Modern Accounting Practices

The landscape of accounting has undergone a dramatic transformation in recent years, largely due to the integration of advanced technologies. This shift has not only

10 Common Bookkeeping Mistakes to Avoid for Financial Success

Bookkeeping is a critical aspect of managing a business’s finances. Accurate bookkeeping ensures that your financial records are up-to-date, which is essential for making informed

The Benefits of Cloud Accounting for Small Businesses

Cloud accounting has become increasingly popular in recent years, revolutionizing the way small businesses manage their finances. With its numerous benefits, it’s no wonder why

Understanding Cryptocurrency and Tax Planning : A Comprehensive Guide

In recent years, cryptocurrencies like Bitcoin, Ethereum, and others have become increasingly prevalent in investment portfolios. As these digital assets gain mainstream acceptance, it’s crucial

Key Labor Facts for Employment in Newfoundland and Labrador: A Comprehensive Guide

As an employer in Newfoundland and Labrador, staying informed about key labor regulations is crucial for ensuring compliance and fostering a fair workplace. This comprehensive guide will delve into the

What Are the Key Labor laws Facts to Keep In Mind about Employment and Employees in Manitoba?

As an employer in Manitoba, it’s essential to stay informed about key labor regulations to ensure compliance and foster a fair workplace. Here are the main employment standards to keep

What Are the Key Labor Facts to Keep In Mind about Employment and Employees in British Columbia?

As an employer in British Columbia (BC), it’s essential to stay informed about key labor regulations to ensure compliance and foster a fair workplace. Here are the main employment standards

What Are the Key Labor Facts to Keep In Mind about Employment and Employees in Northwest Territories?

As an employer in the Northwest Territories (NWT), it’s essential to stay informed about key labor regulations to ensure compliance and foster a fair workplace. Here are the main employment

Key Labor Facts for Employment and Employees in New Brunswick

As an employer in New Brunswick, staying informed about key labor regulations is crucial for compliance and fostering a fair workplace. This comprehensive guide covers essential employment standards, minimum wage

What Are the Key Labor Facts to Keep In Mind about Employment and Employees in Nova Scotia?

As an employer in Nova Scotia, it’s essential to stay informed about key labor regulations to ensure compliance and foster a fair workplace. Here are the main employment standards to

What Are the Key Labor Facts to Keep In Mind about Employment and Employees in Ontario?

As an employer in Ontario, it’s essential to stay informed about key labor regulations to ensure compliance and foster a fair workplace. Here are the main employment standards to keep

What Are the Key Labor Facts to Keep In Mind about Employment and Employees in Alberta?

As an employer in Alberta, it’s crucial to stay informed about key labor regulations to ensure compliance and foster a fair workplace. Here are the main employment standards to keep

Important Considerations When Starting a Business in Alberta

Starting a business in Alberta offers numerous opportunities due to the province’s robust economy and diverse industries. However, success requires careful planning and consideration of several key factors. Here’s a

Self-Employed Individuals: Filing Deadlines and Interest Considerations

Self-employed individuals—including sole proprietors, freelancers, and independent contractors—are required to file personal tax returns with business income by June 15. However, any taxes owed must be paid by April 30…

When to Incorporate from Sole Proprietorship in Canada: A Comprehensive Guide

As a business owner in Canada, transitioning from a sole proprietorship to a corporation is a significant decision that can have far-reaching implications for your business’s future. This guide will

How to Value Your Small Business to Sell at the Best Price: A Guide for Canadian Business Owners

When it comes time to sell your small business, understanding its value is essential to securing the best possible price. By employing a few proven

How to Make Your Business More Appealing to Buyers: A Guide for Canadian Small Business Owners

If you’re considering selling your small business, it’s essential to make it as attractive as possible to potential buyers. By focusing on specific strategies that…

Why Should You Hire 786 Venture CPA to Sell or Buy a Business?

When it comes to buying or selling a business, partnering with a seasoned accounting firm like 786 Venture CPA can make all the difference. This

What is Due Diligence? How Do We Determine if We Need One?

Due diligence is the comprehensive process of assessing all aspects of a business to verify its financials, operations, legal status, and market position. It’s an

Which is the Better Option to Sell Your Business: Asset Sale, Share Sale, or Hybrid Sale?

When selling a business, determining the right transaction structure—asset sale, share sale, or a hybrid sale—is critical to optimizing financial, tax, and operational outcomes for

How Do We Check the Financials?

Evaluating financials is a critical step when selling or buying a business. A thorough review ensures transparency, validates the business’s value, and identifies potential risks.

What Legal Documents Are Necessary for Selling a Business, and Can I Sell without a Lawyer?

Selling a business is a complex transaction involving a series of essential legal documents that outline the terms, protect both parties, and ensure compliance with

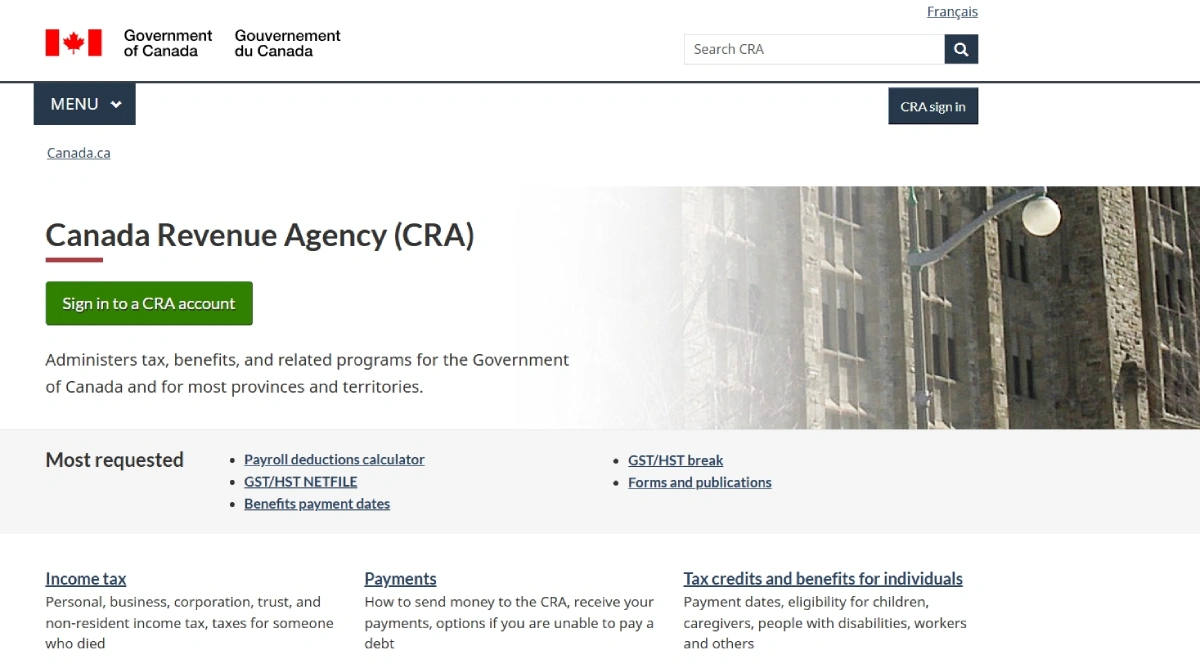

How to Register for CRA My Account

Registering for a Canada Revenue Agency (CRA) My Account is a straightforward process that enables you to manage your tax affairs online securely and efficiently.

Tax free Rollover of crypto assets into the corporation.

As the world of finance continues to evolve, the popularity of cryptocurrencies such as Bitcoin, Ethereum, and others has skyrocketed. With this surge in popularity,

Are There Financing Options, Like Selling Invoices, That Can Help with Cash Flow?

Yes, alternative financing options, such as invoice factoring, can improve cash flow. Invoice factoring involves selling outstanding invoices to a factoring company for immediate cash,

How Do I Know if My Cash Flow is Healthy, and What Can I Do to Improve It?

Healthy cash flow means your business consistently has enough cash to meet expenses without relying on short-term loans or credit. Here’s how to evaluate and…

My Business Has Seasonal Ups and Downs – How Can I Prepare for the Slow Periods?

Seasonal fluctuations in sales can create cash flow challenges. Here’s how to prepare: How to Use a Slow Season Create a Cash Flow Forecast for…

If My Business Has Extra Cash, What’s the Best Way to Use It to Help in the Future?

When you have a cash surplus, using it wisely can set your business up for long-term success. Here are some smart ways to leverage extra

What Steps Can I Take to Rely Less on Short-Term Loans or Credit?

While short-term loans and credit lines can be useful, relying on them heavily can become costly and create cash flow strain. Here’s how to reduce

Inventory Management Strategies to Free Up Cash for Your Business

Efficient inventory management is crucial for maintaining healthy cash flow in your business. Excess inventory ties up capital that could be better utilized elsewhere. Here

How Creating a Cash Flow Forecast Benefits Your Business

A cash flow forecast is a vital tool for businesses of all sizes, providing crucial insights into your financial future. By projecting your cash inflows

Strategies to Get Paid Faster by Your Customers

Getting paid promptly is crucial for maintaining healthy cash flow and sustaining business growth. Here are effective strategies to encourage faster payments from your customers:

How Can I Figure Out the Point Where My Business Starts Making a Profit?

Understanding when your business will start making a profit is crucial for effective financial planning and sustainability. The key to this understanding lies in calculating

How to Create a Comprehensive Cash Flow Forecast

A cash flow forecast helps you plan for future cash needs, giving you insight into potential cash surpluses or shortages. Here’s how to create a